What is a Remotely Created Check? What is an RCC?

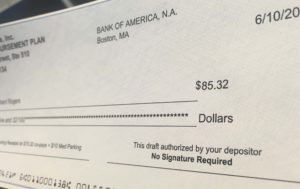

RCCs can be authorized by phone, fax or online by providing the routing number and account number from the original check’s MICR code line.

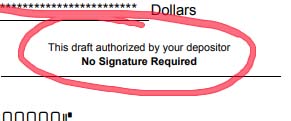

The RCC is then Remotely Created to comply with all Check21 regulations, but has NO SIGNATURE REQUIRED.

In place of the signature is a statement like this:

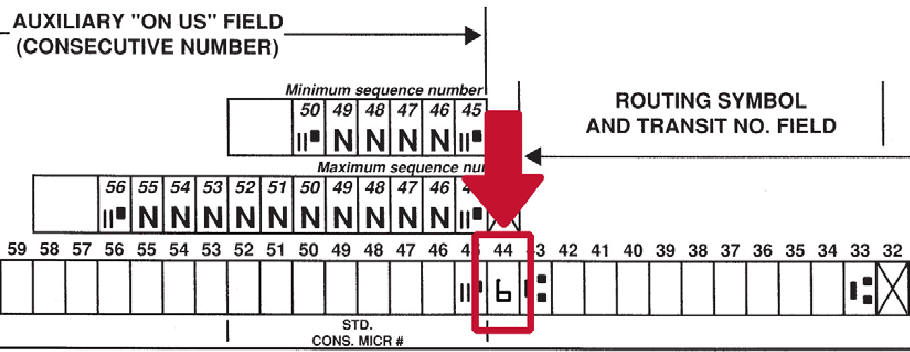

To differentiate an RCC from an original check, a special code is entered in the MICR line called the External Processing Code (EPC). For RCC items the number “6” is used here in CODE LINE 44, just before the routing number.

According to a recent report from the Atlanta Federal Reserve, the most common uses for RCC items are:

1. Pre-authorized drafts, where for example, a consumer approves a payment of its insurance policy and the company issues an unsigned draft.

2. ACH administrative returns, where the ACH item is returned because the information originally provided from the MICR line cannot be properly processed and the merchant resubmits the ACH item as an unsigned draft.

3. Telephone purchases, typically, where telemarketers call selling products or services to companies or individuals, and the telemarketer requests information from the consumer about its bank account for the purposes of obtaining

payment.

4. Depository transfer checks, instances where companies initiate transfer payments between their accounts, some of which may be between different banks.

5. Return item fees, created by merchants to cover fees for returned checks;

6. Bill payment, where the consumer authorizes a creditor such as a credit card company to create a remotely created check in order to timely pay a bill that would otherwise be late if paid with a traditional paper check.

7. (Not mentioned in the Federal Reserve Report) Expedite payments received remotely within a company, for example, a company has 50 drivers deployed nationwide. The drivers collect physical checks from customers. The drivers will relay that data to the company, who then remotely creates a check draft for immediate deposit.

Risk of fraud and returned items like NSF, Stop Payment or Unauthorized is extremely low compared with any other form of check payment according to the Atlanta Federal Reserve Report.

“According to the study, Federal Reserve Banks … volumes for unauthorized returns in other channels such as ACH TEL were higher at 0.13 percent compared with unauthorized remotely created checks returns at 0.03 percent.

This suggests that the aggregate risk exposure for remotely created checks is lower or better managed than believed, or possibly that remotely created checks’ unique risk exposure due to their lack of identification does not in itself manifest unauthorized remotely created checks.”

CONCLUSION:

RCC payments are a low risk, free free way to process payments and expedite funds.